With the results of the 2025 Canadian federal election now confirmed, the Liberal Party has secured another term in office. For many Canadians, the big question is: how will this outcome affect everyday life, financial planning, and the economy?

From inflation and interest rates to housing affordability and consumer confidence, a government’s policy direction can shape how we earn, spend, and borrow. In this article, we’ll break down what the Liberal win could mean for Canadian households—and how flexible financing solutions like those offered by iFinance Canada can help you stay in control of your financial goals, no matter what changes lie ahead.

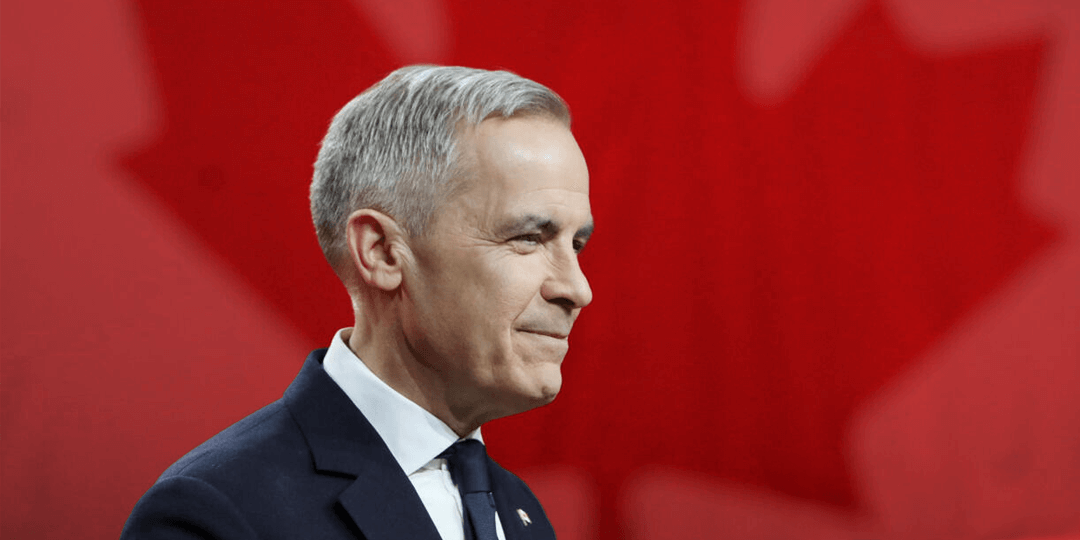

Who Won the Canadian Election in 2025?

On June 17, 2025, the Liberal Party of Canada was officially re-elected, forming a minority government after a tightly contested campaign. While voter turnout was modest, key issues like healthcare, housing, and cost of living dominated the national conversation.

Now, with policy continuity expected in several areas, including climate incentives, tax policy, and social spending, many Canadians are wondering how this will impact their wallets in both the short and long term.

How Will the Liberal Victory Impact Canadians Financially?

1. Cost of Living and Affordability

While the government has pledged to make life more affordable, inflation remains a concern. Groceries, energy costs, and housing continue to strain household budgets across the country. Expect continued policy initiatives around support programs, rent relief, and housing affordability.

2. Taxation and Credits

The Liberals are expected to maintain certain income tax credits while potentially introducing new spending programs to support healthcare, childcare, and green initiatives. These programs could offer relief for some but may also increase pressure on overall public spending.

3. Interest Rates and Lending

With the Bank of Canada expected to hold steady or cautiously lower interest rates, borrowing may become more accessible. However, household debt remains a concern—especially for Canadians managing multiple financial obligations.

Why Flexible Financing Matters in a Shifting Economy

Regardless of political leadership, economic uncertainty is a reality for many Canadians. That’s why flexible, affordable financing options have become essential for managing household budgets.

iFinance Canada offers simple, fast, and transparent financing solutions that help Canadians cover important expenses—like home renovations, healthcare treatments, pet care, and more—without relying on high-interest credit or using savings meant for emergencies.

Here’s what makes our approach different:

- Loans from $500 to $40,000

- Flexible repayment terms from 12 to 84 months

- No down payments or hidden fees

- Instant approvals and direct deposit

- Open loans with no early repayment penalties

- Friendly Canadian-based service 7 days a week

As the cost of living evolves under this government, having the ability to access manageable monthly payment plans can give you financial peace of mind.

Final Thoughts

Political outcomes shape policy—but your personal financial health comes down to how you adapt. Whether you’re facing rising prices, planning a big renovation, or covering unexpected medical expenses, iFinance Canada is here to help you move forward confidently.

To learn more about how our flexible payment plans can support you in any economic climate, visit:

https://ifinancecanada.com